Recognizing the Importance of Insurance Coverage: Shielding Your Future

In today's uncertain globe, understanding the relevance of insurance coverage is essential for protecting your monetary future. Insurance coverage not only offers as a buffer versus unexpected occasions however additionally empowers individuals to pursue their desires with confidence.

What Is Insurance?

Insurance policy is a legal setup that gives economic protection versus potential future losses or responsibilities. Essentially, it offers as a secure for people and businesses, permitting them to move the risk of unforeseen events to an insurance company. This mechanism runs on the principle of risk merging, wherein multiple customers add costs to a cumulative fund. When a covered loss takes place, the insurance provider pays out funds to the affected event, thereby alleviating their economic problem.

The basic parts of insurance consist of the policyholder, the insurance firm, the costs, and the insurance coverage terms. The insurance holder is the private or entity acquiring the insurance policy, while the insurer is the firm giving the protection - insurance. The costs is the quantity paid regularly by the insurance policy holder in exchange for the coverage. Protection terms specify the degree, constraints, and exclusions of security under the policy.

Kinds Of Insurance Protection

A large range of insurance protection options exists to resolve the varied requirements of services and individuals. Each sort of insurance serves an one-of-a-kind purpose, using protection against particular dangers.

Health insurance is essential for making sure and covering clinical expenditures access to healthcare solutions. Car insurance coverage protects lorry owners from financial losses due to accidents, theft, or damages to their automobiles. Home owners insurance coverage safeguards home owners against dangers such as fire, theft, and all-natural calamities.

For services, obligation insurance is important, as it secures versus cases arising from injuries or damages triggered by company operations (insurance). Residential property insurance coverage covers the physical assets of a business, while employees' payment insurance policy gives advantages to staff members hurt at work

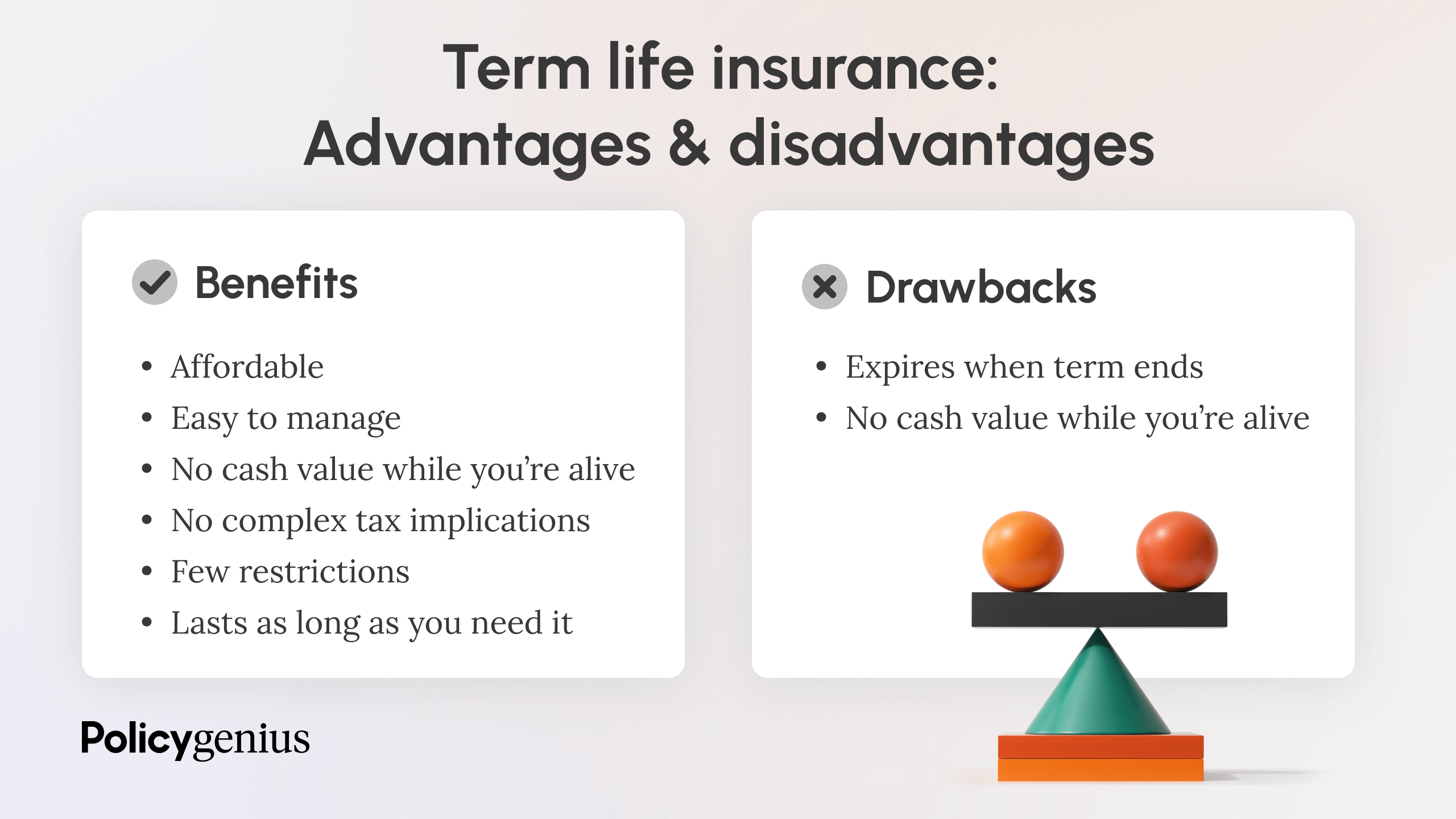

Life insurance policy supplies financial protection to recipients in case of the insured's fatality. Furthermore, impairment insurance policy gives earnings replacement if the policyholder ends up being incapable to function because of illness or injury.

Understanding the different types of insurance policy coverage is vital for making educated decisions regarding personal and service security. By determining specific needs, people and companies can choose the suitable policies to alleviate risks efficiently.

Benefits of Having Insurance Coverage

Having insurance provides people and companies with an essential safeguard that assists mitigate monetary risks related to unexpected events. Among the primary benefits of insurance policy is financial security. By transferring the danger of possible losses to an insurance coverage copyright, insurance policy holders can protect their properties, whether it be a car, home, or business investment.

In addition, insurance advertises peace of mind. Recognizing that you are shielded versus considerable financial problems allows companies and individuals to concentrate on day-to-day procedures without the constant worry of unexpected expenditures. This assurance can enhance total health and productivity.

Insurance policy additionally promotes stability. In case of a loss, such as a natural catastrophe or crash, insurance policy coverage ensures that services and people can recoup extra promptly, lessening disruptions to their lives or procedures. Many insurance policies supply extra advantages, such as accessibility to sources and professional recommendations during crises.

Finally, having insurance policy can facilitate compliance with legal requirements. Particular kinds of insurance, such as obligation coverage, are mandated by regulation, guaranteeing that organizations and individuals operate within the legal framework while shielding themselves versus prospective insurance claims.

Exactly How to Select the Right Plan

Choosing the ideal insurance plan requires cautious factor to consider of individual needs and situations. Begin by analyzing your details requirements, such as your financial circumstance, way of life, and the assets you desire to shield. Identify the types of protection you require, whether it's wellness, home, vehicle, or life insurance policy, and figure out just how much protection is required to properly secure your interests.

Following, study various insurance policy suppliers and their policies. Look for firms with solid financial rankings and positive customer evaluations. Take note of the information of each policy, consisting of costs, deductibles, coverage limitations, and exclusions. It is important to compare different options to discover an equilibrium between price and thorough coverage. insurance.

Usual Mistaken Beliefs About Insurance Coverage

Countless misunderstandings regarding insurance can result in complication and poor decision-making amongst consumers. One prevalent myth is that insurance coverage is an unnecessary expenditure, usually regarded as throwing away money on premiums without concrete advantages. In truth, insurance offers as a safeguard, protecting individuals and family members against significant monetary loss.

One more common false impression is the belief that all insurance coverage are the same. In reality, policies can vary commonly in coverage, exclusions, and costs. It is essential for customers to completely research study and comprehend their choices to ensure they select a policy that meets their details demands.

Many individuals also think that they are automatically covered for all cases under their policy. Nonetheless, many policies have certain exclusions and restrictions, which can cause unforeseen out-of-pocket expenditures. This highlights the importance of carefully reviewing the conditions of look at this web-site any kind of insurance coverage plan.

Last but not least, some people think that submitting a claim will certainly always result in higher costs. While this can be real sometimes, several insurance firms think about the overall danger profile of an insurance holder. Recognizing these mistaken beliefs is important for making educated decisions about insurance policy and guaranteeing correct coverage.

Verdict

In recap, insurance serves as a crucial mechanism for financial security against unexpected occasions, contributing to total security and peace of mind. Resolving common misunderstandings even more enhances understanding of insurance coverage's role in protecting possessions and guaranteeing a secure future for family members and individuals alike.

The insurance policy holder is the individual or entity purchasing the insurance coverage, while the insurance provider is the business offering the protection. In the event of a loss, such as a natural disaster or accident, insurance protection makes certain that organizations and individuals can recuperate a lot more quickly, decreasing interruptions to their lives or operations.Picking the suitable insurance policy calls for mindful consideration of specific demands and scenarios. More Info Identify the kinds of protection you need, whether it's health and wellness, auto, home, or life insurance coverage, and identify how much coverage is needed to appropriately safeguard your interests.

Understanding these false impressions is vital for making informed decisions about insurance coverage and making certain proper protection.